“Nearly 90% of businesses will face a lawsuit at some point” (Feather Insurance).

Liability insurance is a very important protection for both personal and business assets preventing accidents, lawsuits and unforeseen damages. It is usually prescribed by law and saves the assets against litigation as well as court expenses. Liability claims are present in almost 40-percent of all small businesses each year, and the average bodily injury claim within the liability industry is $26,501 and the average property damage claim is at 6,551. Knowledge of the purpose and liability insurance protection types can be used to ensure financial, business and peace of mind protection.

The guide gives a thorough comprehension of what liability insurance is all about, its growing significance in the modern world, and real-life examples and statistics are mentioned.

What Is Liability Insurance?

Liability insurance covers you or your company against the circumstances when you hurt a person or damage their property. It assists in paying attorneys, settlements, and court costs, thus you do not have to spend money.

Key points:

- Bodily Injury Coverage: Pays for injuries you cause to others.

- Property Damage Coverage: Covers damage to someone else’s property.

- Legal Defense Costs: Pays for attorneys and court fees, even if a claim is disputed.

- Premiums and Deductibles: You pay regular premiums and may have a deductible before coverage starts.

As an example, the Insurance Information Institute (III.org) states that the average bodily injury claim is $26,501 and the average property damage claim is $6,551. These bills might be a hard blow to your pocket, especially without insurance. Liability insurance is a common product in a Business Insurance Overview used by businesses to protect you against various risks.

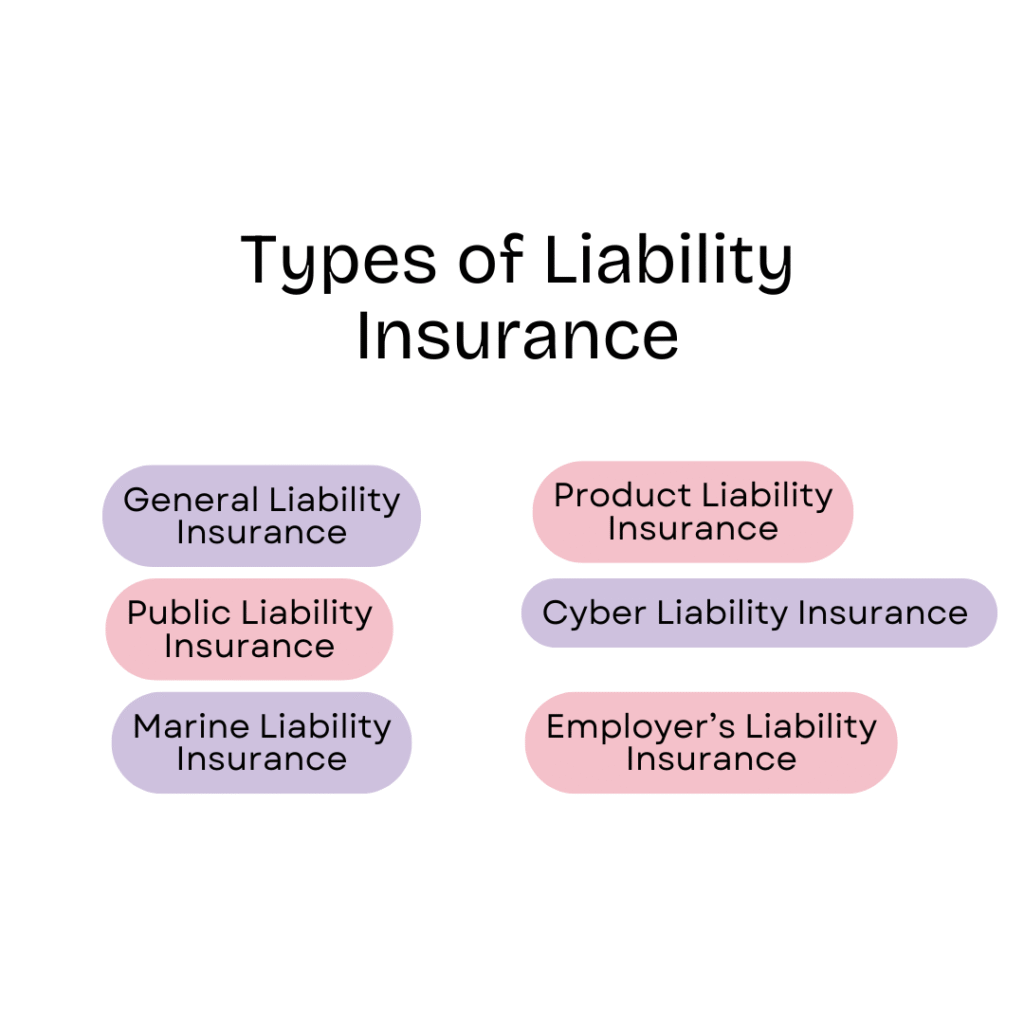

Types of Liability Insurance

Liability insurance is a different name based on different forms of insurance. Each is meant to get you or your business covered against a particular risk. Here is a breakdown of the most typical ones:

Bodily Injury Liability

This insurance is paid to cover medical costs, legal charges or settlement, when a party is physically injured by your actions.

Example: In case a client injures themselves when falling on your shop floor, bodily injury liability will pay toward their treatment.

Property Damage Liability

Coverage against damages to another person/entity’s property you accidentally destroy or damage.

Example: In the event you crash your work truck onto another car, it would cover repair costs with property damage liability insurance.

👉 Learn more about Truck Insurance Basics.

Personal and Advertising Injury

Covers a claim like libel, slander or copyright violation occurring due to the activities of your business.

E.g. In the case that a rival takes you to court over your use of his or her tagline in an advert, this insurance is used to cover the legal defense.

Professional Liability Insurance (Errors & Omissions)

It is also referred to as E&O and covers the professionals against errors, negligence or poor advice that results in the loss of money to a client.

Examples: An accountant has calculated the wrong figures that resulted in a loss of money to a client, the E&O insurance will save him by paying out damages.

Product Liability Insurance

Shields businesses that manufacture or sell products from claims of injury or damage caused by faulty goods.

Example: A defective kitchen appliance that causes burns could trigger product liability coverage.

Umbrella and Excess Liability Coverage

Offers additional distinct coverage beyond a normal liability insurance, replacing huge claims that are beyond ordinary policy limits.

Scenario example: when the verdict of a lawsuit causes a loss of 2 million dollars and you have insured your liabilities used a policy that allows you to claim 1 million dollars, an umbrella cover completes the difference.

How Liability Insurance Works

Knowing the nature of liability insurance can allow you to visualize the coverage you receive and how claims are processed. Essentially, liability insurance covers an expense or legal fees in the event that you are responsible in damaging another person or property.

The distinction between claims-made and occurrence policies is one of the important aspects of the functionality of policies

- Claims-made policies cover incidents only if the claim is filed while the policy is active.

- Occurrence policies cover incidents that happened during the coverage period, even if the claim is filed years later.

Another example is that a doctor who had malpractice coverage on an occurrence policy is covered on any procedure that he has done under an active policy irrespective of whether the patient sues him after. Conversely, a claims-made policy claims coverage only when a lawsuit is made during the policy. The premiums and deductibles affect policy costs.

Stat to Know: The average homeowners liability claim payout is $22,611 (PolicyGenius), showing just how valuable this coverage can be.

Why Liability Insurance Is Required

Liability insurance plays an important role in fulfilling the legal requirements of the people to cover personal or business assets against litigation. Driver coverage to recoup injury or property costs are required by most states. California passed a new law that increased the minimum auto liability limits to 30/60/15 that began in 2025. Liability insurance is also necessary to cover the claims of injury, accident or damage to third parties by businesses since an individual lawsuit can be enough to threaten assets and operations.

Trends & Challenges in Liability Insurance

Staying updated with modern trends in liability insurance is an important factor in businesses that seek to remain insured and effectively deal with the risk inherent in the body. Liability coverage has grown in cost and complexity over the last several years as a result of a combination of increased claim costs as well as new exposures.

📈 One major trend: Commercial liability premiums have risen for 23 straight quarters, climbing another 8% in 2025 (FT.com). This long-term increase reflects higher settlement amounts, legal fees, and broader exposures that insurers must account for.

At the same time, new risks are reshaping the landscape. Emerging technologies like artificial intelligence and deepfakes bring potential liability exposures—from privacy violations to copyright disputes—that traditional policies weren’t designed to handle. Businesses now need to think beyond standard protection and consider umbrella or excess liability coverage for added security.

Want a full picture of coverage options? Explore our Business Insurance Overview.

Conclusion

Appropriate liability insurance protection is not only what the law requires or about protecting your finances, assets, and peace of mind. As an individual, a homeowner, or a business holder, the liability coverage assures personal protection against unforeseen lawsuits, high-cost claims, and risks that would otherwise cost you compensation expenses.

At SecurePolicyNow, we are partnered with trusted carriers, and our years of experience allow us to offer you the coverage that best meets your specific needs. Our customer-centric business philosophy will ensure that you have all the guidance, support, and solutions to help you feel confident of your protection.

FAQs

What is the average cost of a bodily injury liability claim?

The average bodily injury liability claim costs $26,501, showing how expensive accidents can be (III.org).

How many small businesses face lawsuits each year?

About 36–53% of small businesses face a lawsuit annually, highlighting the need for coverage (Feather Insurance).

Are liability claims common in homeowners insurance?

They’re rare—only 2% of claims—but very costly, averaging $30,324 per payout (PolicyGenius).

What are the new California auto liability insurance minimums?

Starting in 2025, California requires 30/60/15 coverage, with premiums rising about $80–$400 (SF Chronicle).

Why are liability insurance premiums rising for businesses?

Premiums have climbed for 23 straight quarters, including an 8% increase in 2025 (FT.com).