HEALTH INSURANCE

Health insurance is a policy that helps you cover medical care. It pays a portion of the expenses of medical bills, hospitalizations, testing, and even emergency procedures. Good health today doesn’t guarantee protection from unexpected illness or injury. Take, for example, a broken leg, which could cost $7,500 and even a couple of days spent in the hospital may cost over $30,000. Major diseases like cancer could cost up to hundreds of thousands of dollars to treat. Without insurance, you may use savings or go into debt to cover the care. Health insurance will prevent large bills, and it also covers routine checkups and screening.

Why is health insurance important?

Health insurance not only keeps you healthy and gets you the care you need on time, but it also keeps medical costs down. Approximately, 90 percent of individuals in the US now have health insurance cover due to innovative programs like the Affordable Care Act. It allowed about 20 million more people to be covered by Medicaid, employment, or privately. However, over 28 million of the American population lack insurance and risk both health and economic damage in case of illness.

When you are insured you are able to do routine checkups, vaccines, cancer screening and treatment in case you are ill or injured. It facilitates good health and well being too. This type of insurance enables you to do your daily routine, spend time with family, and work without fearing a medical emergency. Proper health insurance in a word gives a better, safer and more productive life.

How does health insurance work?

Health insurance assists you in covering health care as and when you need it. When you purchase a plan and pay your first monthly bill (known as a premium), your coverage begins. To keep your insurance coverage active, you must continue to pay the monthly fee. When you qualify, the government can pay part of your premium in a subsidy. This is a direct support to your insurance company which reduces your monthly cost. Most health plans have a deductible.

Even after meeting the deductible, you might still share costs. This includes:

- Copayments (Copays): A fixed fee you pay for things like doctor visits or prescriptions.

- Coinsurance: A percentage amount of your total bill towards some services.

A network of doctors, hospitals and other providers will be listed in your insurance plan. These are called in-network providers. Visiting them usually saves you money. If you go to a provider outside your network, you may have to pay more or even all of the bill.

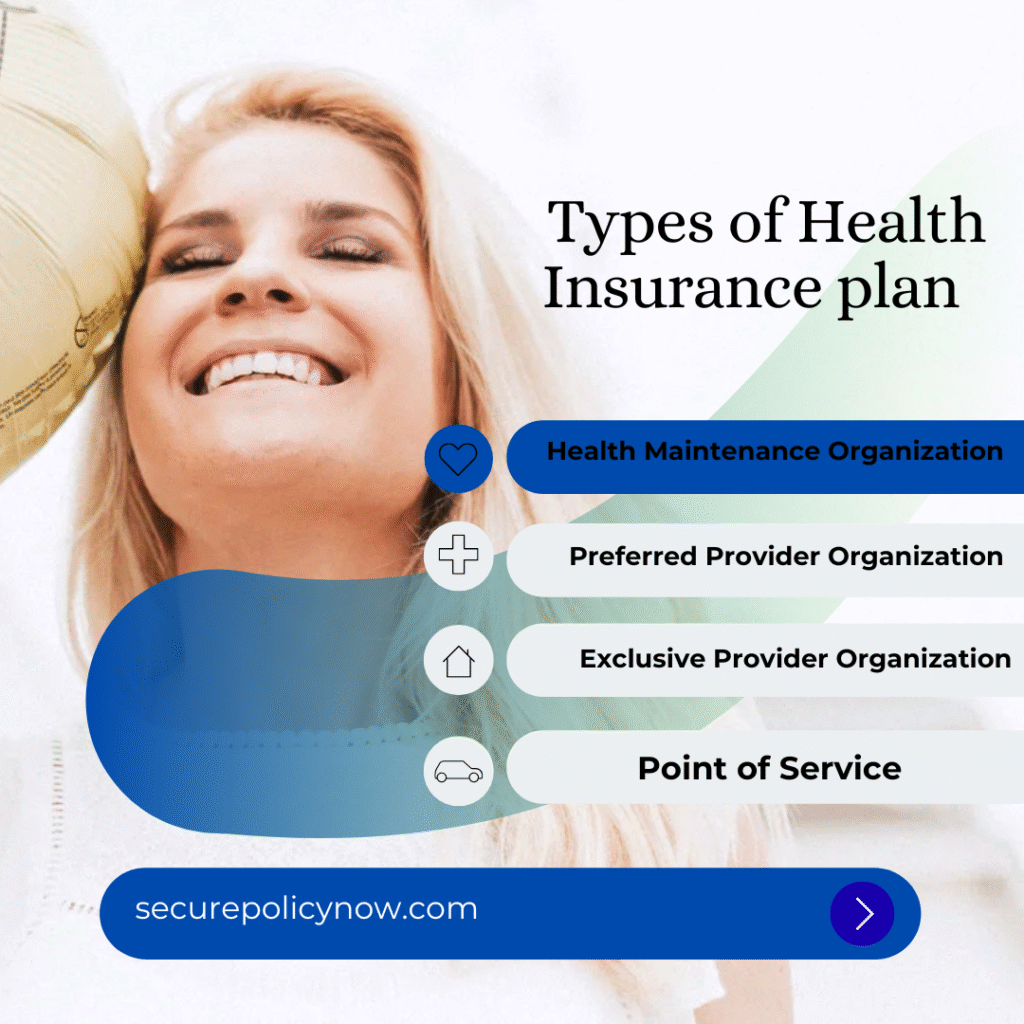

Types of Health Insurance Plans

Different plan types have different rules:

- HMO plans usually only cover care from in-network providers.

- EPO plans often require you to use specific providers for things like prescriptions or medical equipment.

- PPO Plans provide flexibility, higher premiums, out-of-network care, and do not require a primary care provider referral for specialist visits.

- (POS) plans combine elements of HMO and PPO, covering out-of-network care and requiring primary care providers to refer patients to specialists.

A lot of health insurance plans have added benefits such as wellness programs or discounts on fitness or incentives to remain healthy and do not charge you anything additional. Another term is “short term insurance”. Short term health insurance in the US is temporary, limited-duration plans designed to bridge the gap between longer-term plans for individuals in need.

Health insurance options for unemployed

You can keep your health insurance for a short time through COBRA after leaving a job. But once those benefits end, you’ll need to find other options. The Affordable Care Act (ACA) can help you obtain health insurance even when you are unemployed. There are numerous large health insurance companies; they will help you find a plan even when you are jobless.

Why do college students need health insurance?

Students may avoid health insurance for economic reasons, which is risky. About 20% of full-time students do not have insurance, so they would face massive medical bills in case of an accident, injury, or serious health issue.

Though elementary colleges provide low-cost health insurance, the coverage is not always enough and the deductible is high.

A better option? Keep the student on a parent’s health plan. Thanks to the Affordable Care Act (ACA), they can stay on it until age 26, even if they’re in college full-time. Just make sure the plan includes in-network providers near the college.

Top health insurance companies

There are many good health partners insurance, but finding the one that best meets your needs takes some time.

At SecurePolicyNow, we did the homework to help you choose the right health insurance provider for 2025. We researched how people across the country feel about their health insurance companies. We focused on key areas like trust, renewal intentions, and whether customers find their plans affordable. We also reviewed national data from trusted sources:

- NCQA (National Committee for Quality Assurance) for plan quality ratings

- NAIC (National Association of Insurance Commissioners) to check customer complaints

- AM Best to assess each company’s financial strength

Using all this information, we identified the top health insurance companies for 2025 based on performance, trust, and overall value.

According to a December 2024 report from the American Medical Association:

- UnitedHealthcare holds 15% of the market

- Elevance has 12%

- Aetna also has 12%

- Cigna holds 11%

- Health Care Service Corp and Kaiser Permanente each have 7%

These companies lead the industry in both size and coverage.

Choose the right health insurance plan for you

Choosing a health insurance plan doesn’t have to be confusing. Start by thinking about what matters most to you like low monthly costs, coverage for your current doctor, or help with prescriptions. Take your time to compare plans. Look at what each one covers, what you’ll pay out of pocket, and if your favorite clinics are included. Whether you’re working, between jobs, or in college, there’s a plan out there for you. At SecurePolicyNow, we’ve done the research to make it easier. You deserve care that fits your life and your budget.

FAQs

Who offers short-term health insurance?

You can get short-term health plans from private insurers like UnitedHealthcare, National General, or Pivot Health for temporary coverage.

Is it illegal to not have health insurance?

It’s not illegal in most states, but a few like California and Massachusetts—may charge you a penalty if you don’t have coverage.

What is a deductible in health insurance?

It’s the amount you pay out of your own pocket before your insurance starts helping with the bills.

What is a health insurance premium?

That’s your monthly payment to keep your health insurance active, even if you don’t use it every month.

How much is health insurance a month?

It depends on your plan and where you live, but most people pay between $450 and $550 a month for individual coverage..

Does health insurance cover therapy?

Yes, many plans do cover therapy, especially for mental health but the details depend on your provider and plan.