Planning the end of life is an emotional subject to deal with but in a way is empowering. Life insurance is not just a policy, it is a financial safety net to your loved ones. This offers a tax-free income that may assist in paying mortgage, debts, daily expenses, or education when someone dies. More than 52% of American adults own a life insurance policy, and young persons may now more easily get affordable insurance. Which demonstrates its importance in financial planning. Other contemporary policies provide chronic illness living benefits or retirement needs. Its importance is also indicated by the fact that millions are covered in government programs like FEGLI. What will you do without protective life insurance? It can help to provide your loved ones with financial security at a time when they need it most, whether you are building a family or getting ready to retire.

Let us consider the basics!

What is Life Insurance?

The details of how it works, why you may want to consider it, and how to get a quote.

It is an arrangement between you and an insurer to provide a financial incentive to your loved ones in the unfortunate scenario of your death. The insurer will pay them a certain amount of money, known as a death benefit, in exchange for a monthly or yearly payment, called a premium.

What does life insurance cover?

Life insurance, at its basic level, is a financial backup. It is set up to cover the loss of income, pay off large debts (including house mortgages or credit cards), end of life costs, or other future requirements like college tuition to a child. The advantage is that it is generally free of income tax and thus is a secure and effective method of dividing financial assistance.

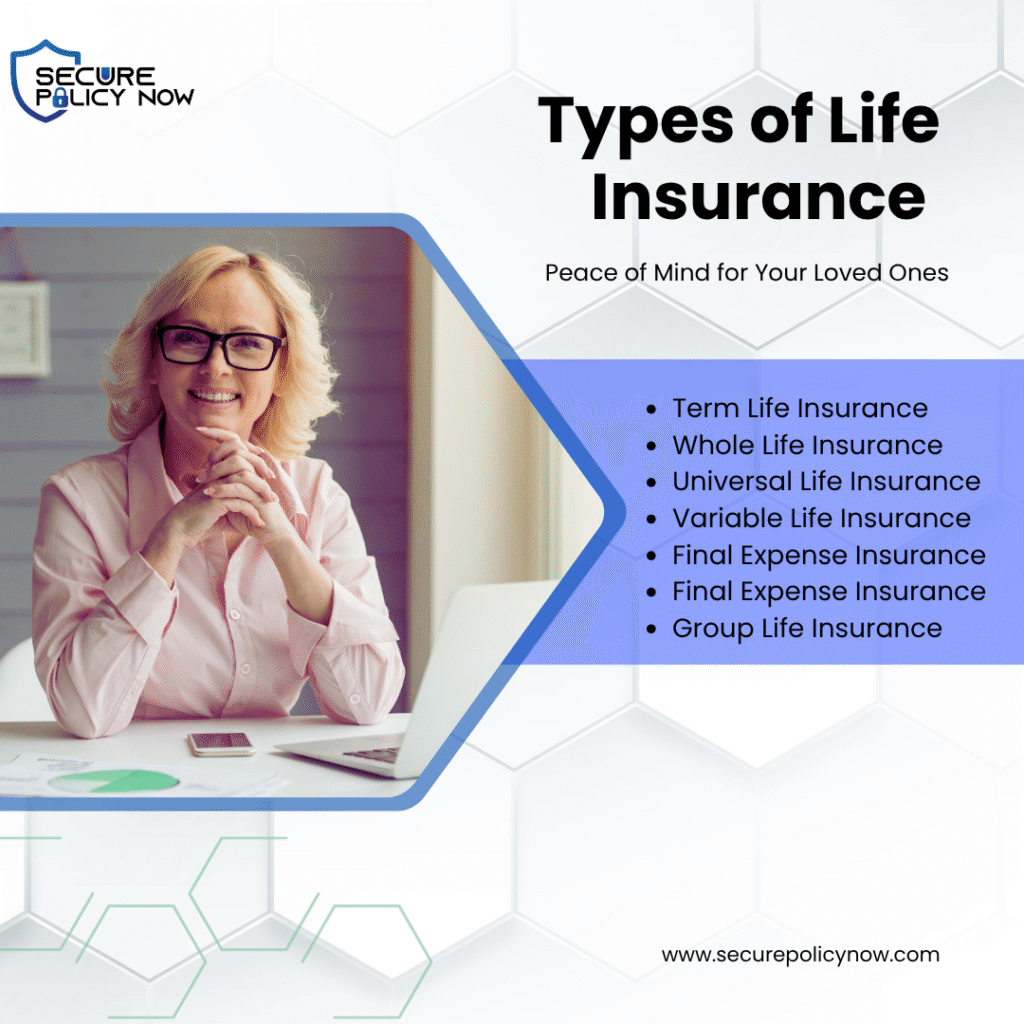

3 Major types of life Insurance:

One of the most important ways to protect family members and plan for the future is to choose a life insurance policy. Term life, whole life, and universal life are the 3 main components of this type of insurance.

Term Life Insurance:

It provides a cover over a specific time (e.g. 10, 20 or 30 years). It is typically less expensive and is best suited to insure significant obligations at some point in your life.

Whole (or Permanent) Life Insurance:

It covers you throughout your life and not within a fixed duration. It also comes with a cash value which increases with time. Having this cash value, you can take out a loan and use it in case of an emergency and because you are alive, this is a great financial backup option.

Universal Life Insurance

Universal Life Insurance offers flexibility in coverage and death benefits, allowing individuals to adjust premium payments and death benefits as circumstances change. It gains cash value like whole life insurance but with greater control and options, and can also provide joint coverage for estate transfers.

Group term life insurance may be provided by some government insurance programs such as FEGLI, in which basic life insurance can usually be included automatically, and extra features may be added at the employee’s choice.

TIP: The FEGLI Calculator allows users to calculate the face value, premiums, and impact of options on life insurance amounts and withholdings, as well as the changes in life insurance after retirement.

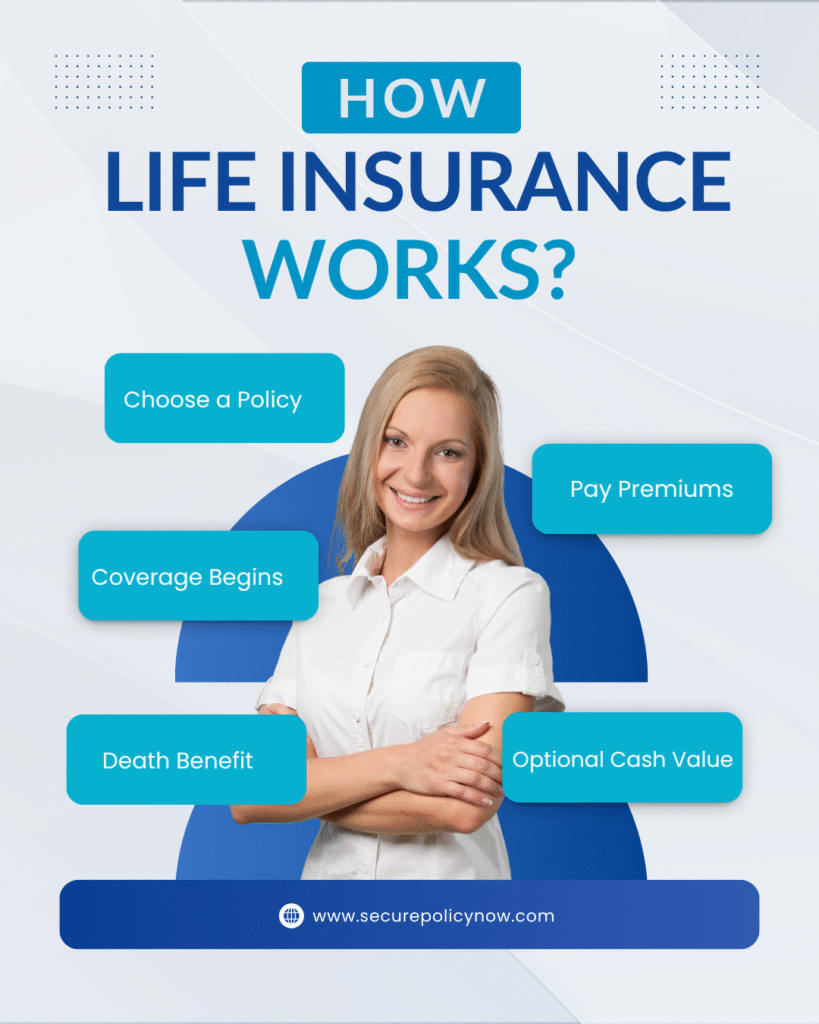

How Life Insurance Works

Select Your Coverage Amount

Start by choosing an amount of life insurance you want (for example, $50,000 worth of coverage).

Choose the Correct Type of Policy

Determine the type that fits your needs the best; some of the most common are term life, whole life, and final expense insurance.

Pay Premiums

Make your policy active by paying regular premiums in time.

Payout to Your Beneficiary

When you die due to a covered cause, your beneficiary gets the death benefit, as long as it is up to a maximum of 112,500, depending on your policy.

How much life insurance should I get?

To calculate the value of your life insurance policy, you can use these methods:

1. Calculate your current salary by multiplying it 7-10 times.

2. Calculate your capital needs by adding up all current expenses, including income replacement for beneficiaries, education, debt, and unpaid work. Add these to the total.

3. Calculate your human life value by adding up your income and unpaid services from now until retirement, and subtracting 20-40% in taxes.

These are fast and reliable methods and they can enable you to calculate the right value of your life insurance. These are some of the factors that you should put into consideration so that you can wisely plan about your life insurance cover.

When and How to Get Life Insurance Coverage

Some of the milestones in life cause people to consider purchasing life insurance. The three most typical causes are having a child, getting married, and purchasing a new house. All of these things have more financial responsibilities as well as the possibility of new family members relying on you financially. Proper life insurance can assure that they are safe in case something unexpected occurs.

Getting covered by life insurance has a couple of convenient methods too. You may get it via your employer as a workplace benefit, online (via credible service providers), or you may contact and work directly with a financial planner who will assist you according to your unique requirements.

Find the right life insurance solution

Life insurance would allow you to have a better control of all the wonderful and challenging things that life presents. It can make you feel more financially secure and the future of your family is safe. Just like choosing any other kind of insurance, selecting a life insurance coverage might be uncomfortable. With so many options, each with its unique features and laws, you must determine what best suits your preferences. When comparing differences, use an online comparison tool. The process doesn’t have to be tough even if it could initially seem frustrating. This information will help you to make more informed financial decisions that can lead to a more fulfilling, safer future for yourself and your family members.

FAQ’s

Is life insurance compulsory in the USA?

No, life insurance is not required by law in the U.S. It’s entirely optional and based on personal needs.

How much is a $1 million life insurance policy?

The cost varies depending on age, health, and term length. On average, it ranges from $30 to $250 per month.

Do you pay life insurance monthly or yearly?

You can pay premiums either monthly or annually. Most people choose monthly payments for easier budgeting.

How long until life insurance is paid?

Most life insurance payouts are completed within 30 to 60 days after a valid claim is submitted.

How long does Senior Life Insurance take to pay out a claim?

Typically, approved claims are paid within 30 to 60 days. Delays can occur if documentation is incomplete.